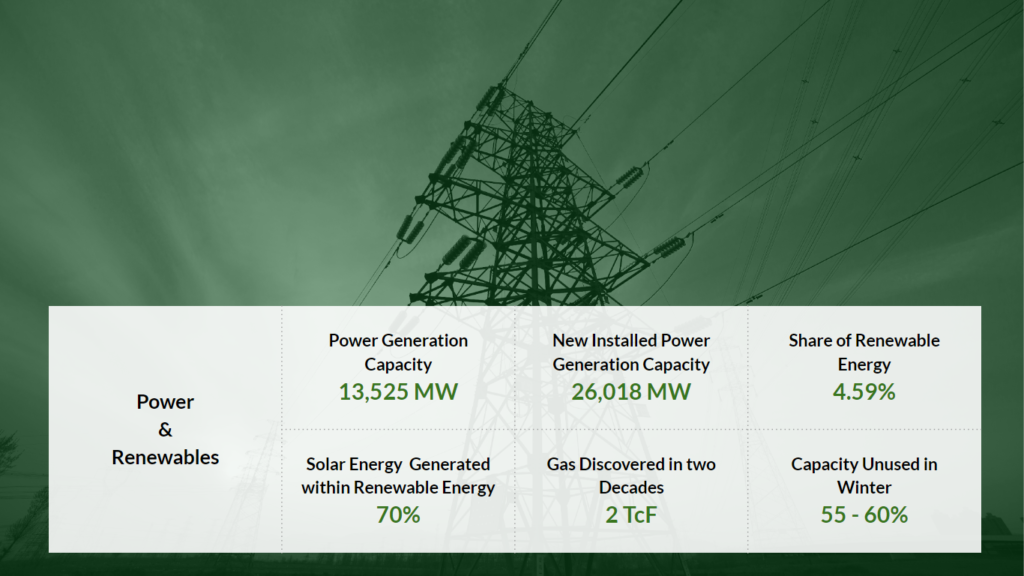

Over the past decade, Bangladesh’s power sector has undergone significant expansion. In the fiscal year 2010-11, the maximum power generation capacity stood at 4,890 MW, but by the fiscal year 2021-22, this capacity had risen to 13,525 MW. For a substantial period, Bangladesh relied heavily on a mono-energy fuel supply system based on natural gas. In fact, as late as 2010, 90% of the country’s electricity was generated by local gas-powered plants. However, due to the depletion of local gas reserves, Bangladesh had to transition to a more diversified energy mix, incorporating coal, oil, LNG, nuclear, cross-border power imports, alongside reduced reliance on local natural gas. Presently, Bangladesh’s power sector is one of the most fossil fuel-dependent in Asia, with fossil fuels accounting for a staggering 98% of the energy mix, as reported by Ember’s Global Electricity Review in 20231.

According to the Sustainable and Renewable Energy Development Authority (SREDA), the total installed power generation capacity in Bangladesh as of 2023 stands at 26,018 MW, including both captive and imported energy. However, renewable energy sources constitute a mere 4.59% of the electricity generation mix. This figure lags significantly behind neighboring countries like India (23%) and Pakistan (43%) in South Asia2.

The gas shortage predicament, which began in 2007 with a shortfall of 300 million standard cubic feet per day (mmcfd), has escalated to a staggering 1,300 mmcfd, resulting in the country’s increasing dependence on imported fuel sources, subjecting it to international price fluctuations and supply risks. The economic repercussions of the Russia-Ukraine conflict led to a substantial spike in LNG import prices, with the average cost per cubic meter (mmcm) reaching BDT 75.81. As a result, Bangladeshi consumers experienced higher energy costs. Despite the country’s consumption of approximately 13 trillion cubic feet (Tcf) of gas over the past two decades, it has made limited discoveries, amounting to less than 2 Tcf, prompting a shift towards renewable energy sources. Consequently, Bangladesh has committed to the Climate Vulnerable Forum (CVF) to generate 40% of its electricity from renewable sources by 2041.

Currently, solar energy constitutes the majority, accounting for 70% of the country’s renewable energy sources. However, hydro and wind energy have faced challenges due to the geographical constraints of Bangladesh, limiting their growth prospects in the sector3.

Additionally, the sector’s BCI score of -6.2 primarily results from concerns about weak industrial performance caused by the global increase in energy prices, which could create an imbalance between supply and demand.

| Fuel/Resource | Installed Capacity | Share |

| Coal | 1768 MW | 6.8 % |

| Gas | 11476 MW | 44.11 % |

| HFO | 6278 MW | 24.13 % |

| HSD | 1341 MW | 5.15 % |

| Imported | 1160 MW | 4.46 % |

| Renewable | 1195.34 MW | 4.59 % |

| Captive | 2800 MW | 10.76 % |

| Total | 26018 MW | |

1The Electricity Sector in Bangladesh: What Comes Next?

2National Database of Renewable Energy

3Bangladesh Economic Review 2022

Bangladesh also has plans to export its excess electricity to neighboring countries, particularly India, Nepal, and Bhutan, using the Indian Energy Exchange, a platform designed to facilitate power trading. This surplus electricity export will primarily occur during the winter season when demand decreases due to cold weather.

Typically, during the winter period, approximately 55-60% of the power generation capacity remains unused, as demand drops to approximately 8,000-8,500 megawatts. Maintaining such a significant unused capacity has resulted in operational losses for the Bangladesh Power Development Board (BPDB). In the fiscal year 2021, these losses amounted to Tk11,509.12 crore, marking a 54.5% increase from the Tk7,450.24 crore losses incurred in the previous fiscal year.

Over the last 13 years, commencing in 2009, the power sector of Bangladesh has garnered foreign investments totaling $30 billion. One such example of this is the Rooppur Nuclear Power Plant (RNPP), a project valued at $12.65 billion, with the financial backing of Russia covering 90% of the costs. Bangladesh will be required to repay the loan over a span of 28 years, with a grace period of 10 years included. Consequently, China also has a high FDI contribution in Bangladesh. The country has invested a cumulative amount of $450 million in Bangladesh’s power sector, exclusively in fossil fuel-based power plants.

| Sector | No. of Projects |

| Public Sector | 12 |

| JV | 3 |

| Private Sector | 18 |

| Total (Under Construction) | 33 |

| Installed Capacity (By Sector) | Share % |

| Private Sector | 44% |

| Public Sector | 45% |

| JV | 6% |

| Imported power | 5% |

Various government policies and initiatives have exerted an influence on Bangladesh’s power sector over time:

The nation is currently in dire need of a substantial overhaul of its power generation sector. This overhaul should encompass decarbonization efforts, a reduction in reliance on imported fossil fuels, a significant expansion of renewable energy sources, and enhancements to its electricity grid infrastructure. Failing to proactively address these aspects exposes the country to several risks. With the ongoing growth in power demand, the country’s increasing dependence on imported fossil fuels leaves it vulnerable to the volatility of global fuel prices. This heightened reliance on foreign fossil fuels for power generation has amplified overall risks, leading to adverse effects on foreign currency reserves and an increase in subsidy expenditures.

The demand for electricity is expected to continue its upward trajectory, prompting the government to actively promote the adoption of renewable energy sources for power generation. Moreover, as industrialization advances, the requirement for electricity escalates. For instance, ensuring the availability of affordable electricity is of paramount importance for Bangladesh’s garment industry, which contributes over 16% to the country’s GDP. Additionally, Economic Zones house numerous businesses, making them potential locations for the installation of solar power systems to meet the substantial energy needs of these enterprises.

Furthermore, the government is engaged in collaborative efforts with neighboring countries, as well as regional organizations like SAARC, BIMSTEC, SASEC, and D-8, to foster regional cooperation. Initiatives involving cross-border electricity trade through bilateral agreements with Nepal, Bhutan, and India are being explored, rendering the power sector an attractive option for investment. In fact, the power sector alone accounts for 14% of the total foreign direct investment (FDI) inflow into the country.

Gain perspectives of the emerging sectors of Bangladesh

InsightsContact us for a comprehensive understanding of the investment landscape in Bangladesh